Dive into the intricate universe of VAT and tax with our enlightening insights. For any international trade for your business or your clients, we’ve got you covered.

INTERNATIONAL TAX & PAYMENT EXPERTS

Digital Taxes Around the World: Navigating a Complex Landscape

Digital taxation has become a central issue for governments as the global economy shifts increasingly online. With digital giants generating significant revenue from markets without a physical presence, countries have sought new ways to ensure fair taxation. However, the implementation of these taxes varies widely across jurisdictions, presenting challenges for multinational companies. Here’s a look […]

Understanding Different Types of Technology for Settling Tax Liabilities, Including Desucla’s TaxPay Solution

In today’s digital age, businesses face evolving complexities when it comes to managing their tax obligations. As companies grow and expand their global footprint, managing tax compliance efficiently and settling tax liabilities in different jurisdictions can become a significant challenge. Fortunately, technology offers various solutions that simplify this process, allowing businesses to focus more on […]

Understanding Payment Methods and Corporate and other Tax Types in the United States

In the United States, corporate and business taxes vary significantly from state to state, making it essential for businesses to understand the tax landscape in each region they operate. Beyond federal taxes, companies must navigate various state-level taxes, including corporate income tax, real estate taxes, sales taxes, and others. Payment methods for these taxes can […]

TaxPay Series. Making International Tax Payments Easy – France, Italy, Spain & Romania

Our first article in our TaxPay series, explaining some of the challenges in making international tax payments and solutions to those challenges. Payment Methods for Settling Taxes in EU Countries: France, Italy, Spain, and Romania Paying taxes in different EU countries requires businesses to navigate various national procedures, systems, and payment methods. Each country has […]

Your Trusted Indirect Representative for EU Customs Imports

Understanding Indirect Representation in EU Customs When importing goods into the European Union (EU), businesses have two primary options for customs representation: direct and indirect. Understanding the difference between these two can significantly impact the efficiency, compliance, and liability of your import operations. What is Indirect Representation? Indirect representation involves appointing a third party, like […]

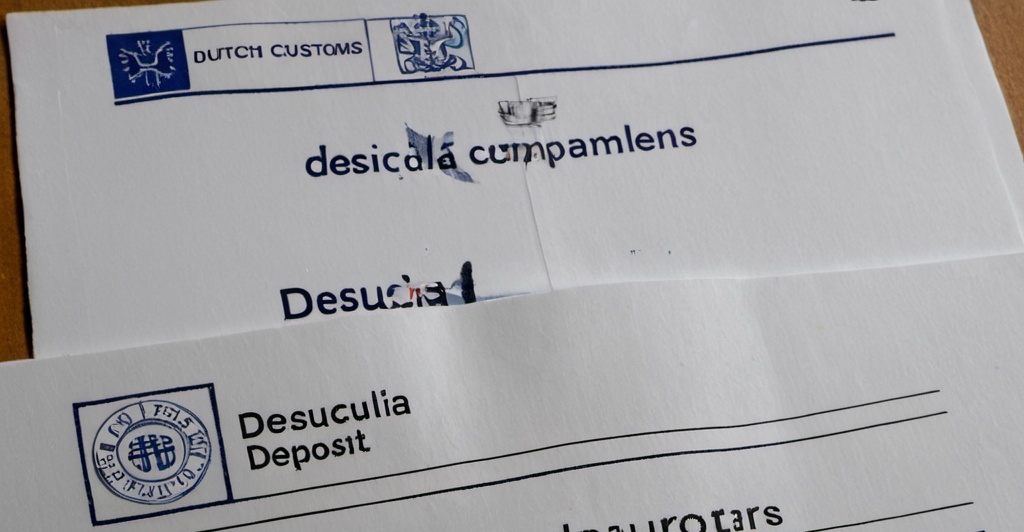

Understanding the Deposit Requirement for Importing Goods into the EU

Understanding the Deposit Requirement for Importing Goods into the EU from the Netherlands and How to Avoid It When importing goods into the European Union (EU) through the Netherlands, businesses often encounter various financial and regulatory requirements. One significant aspect is the deposit that may be required by Dutch customs authorities. This deposit is intended […]

Your Trusted Importer of Record and Indirect Representative for EU Imports

Desucla: Your Trusted Importer of Record (IOR) and Indirect Representative for EU Imports When importing goods into the European Union (EU), ensuring compliance with complex customs regulations and legal obligations is crucial for smooth and successful operations. One of the key roles in this process is the Importer of Record (IOR). Desucla offers specialized services […]

VAT & Customs Representation in the Netherlands

Desucla acts as fiscal representative in all EU states and in some countries outside the EU. It is a formal requirement to appoint a fiscal representative in up to 20 EU member states. The rep once appointed stands in the shoes of the foreign business. A fiscal rep acts as the VAT representative and is […]

Understanding Customs Representation: Direct vs. Indirect Representation

Desucla: Your Trusted Partner for EU Customs Imports When importing goods into the European Union (EU), navigating customs regulations is a crucial step in ensuring the smooth flow of your products. One of the key decisions you must make is whether to choose direct or indirect representation for your customs procedures. Understanding the difference between […]